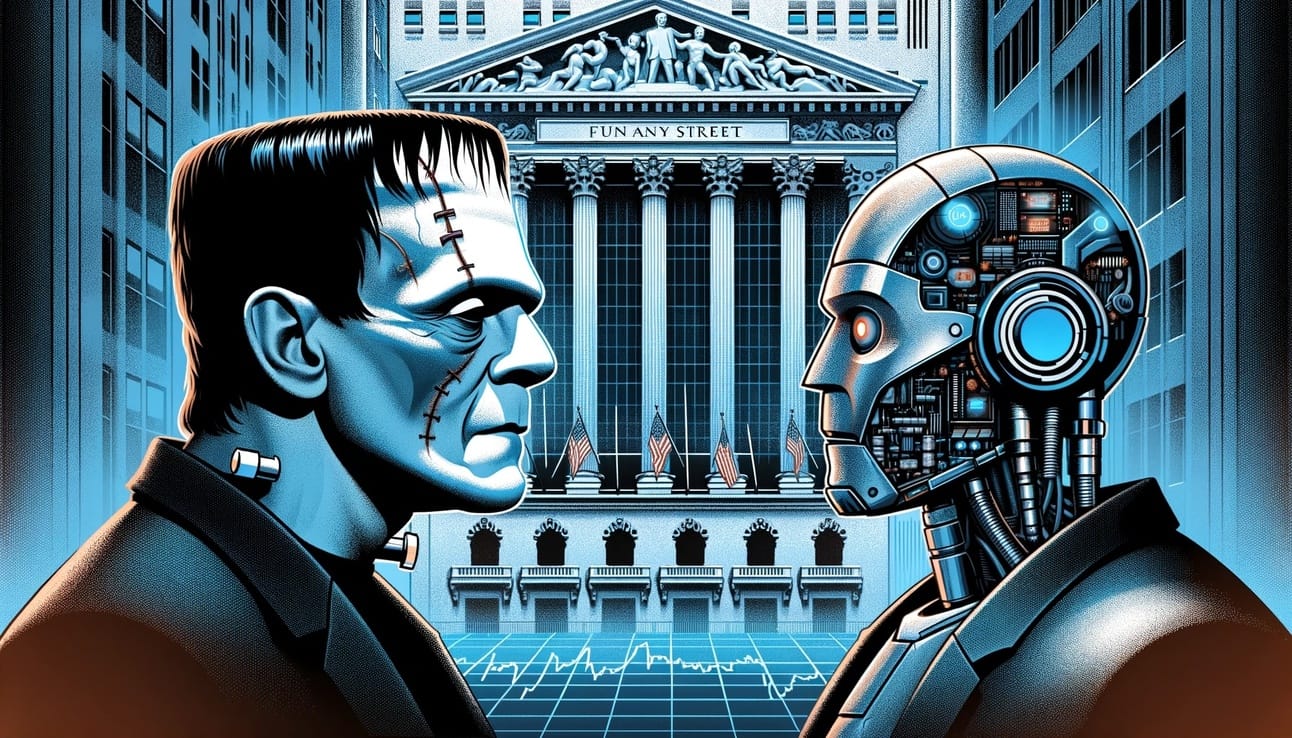

The Frankenstein Effect

Navigating AI Risks and Rewards of Autonomous Financial Systems

The Frankenstein Effect and Autonomous Financial Systems

Mary Shelley's classic gothic novel Frankenstein, first published in 1818, tells the story of Victor Frankenstein, an ambitious young scientist who creates a sapient creature in his laboratory through an ambiguous method based on chemistry and alchemy. While at first exhilarated by his achievement, Frankenstein is soon horrified by the hideous appearance of the creature and abandons it. The creature goes on to pursue Frankenstein for the injustice done to him, leading to tragedy and Frankenstein's ultimate demise.

While a work of speculative fiction, Frankenstein raises many profound questions that remain highly relevant today as we grapple with the implications of creating artificial intelligence. Some key themes emerge from the novel that are particularly germane to the development of AI and its impact on finance and the economy:

The Pursuit of Knowledge and Discovery

A central theme in Frankenstein is the relentless pursuit of knowledge and discovery without proper consideration of the ramifications. Victor Frankenstein is driven by a compulsive need to push the boundaries of science and unlock the mysteries of life itself. However, he barrels forward recklessly with his experiments, failing to fully contemplate the potential negative consequences of bestowing life on inanimate matter.

"Learn from me, if not by my precepts, at least by my example, how dangerous is the acquirement of knowledge, and how much happier that man is who believes his native town to be his world, than he who aspires to become greater than his nature will allow."

In the realm of AI and finance, we see similar trends emerging. There is a feverish race underway among Wall Street firms, hedge funds, big tech companies, and nations to develop ever-more sophisticated AI systems for algorithmic trading, portfolio management, fraud detection, underwriting, economic forecasting and more. The potential advantages, in terms of enhanced efficiency, accuracy, and profitability, are immense.

But like Victor Frankenstein, are those developing these financial AI systems pausing to truly examine the possible repercussions? Could AI-driven algorithmic trading lead to "flash crashes" that destabilize markets in unpredictable ways? Might AI portfolio managers allocate capital in ways that exacerbate inequality? Could AI credit scoring models unintentionally discriminate against protected classes of borrowers? Will the productivity gains from financial AI lead to widespread job losses in the industry?